Skills development levy

As per the Skills Development Levies Act (No 9 of 1999) (SDLA), a compulsory levy scheme for the purpose of funding education and training was established. This was envisaged in the Skills Development Act (No 97 of 1998) (SDA).

This payable levy came into effect as of 1 April 2000. The Department of Higher Education and Training, in conjunction with various SETAs, is responsible for administering this Act, with the South African Revenue Service (SARS) collecting all levies.

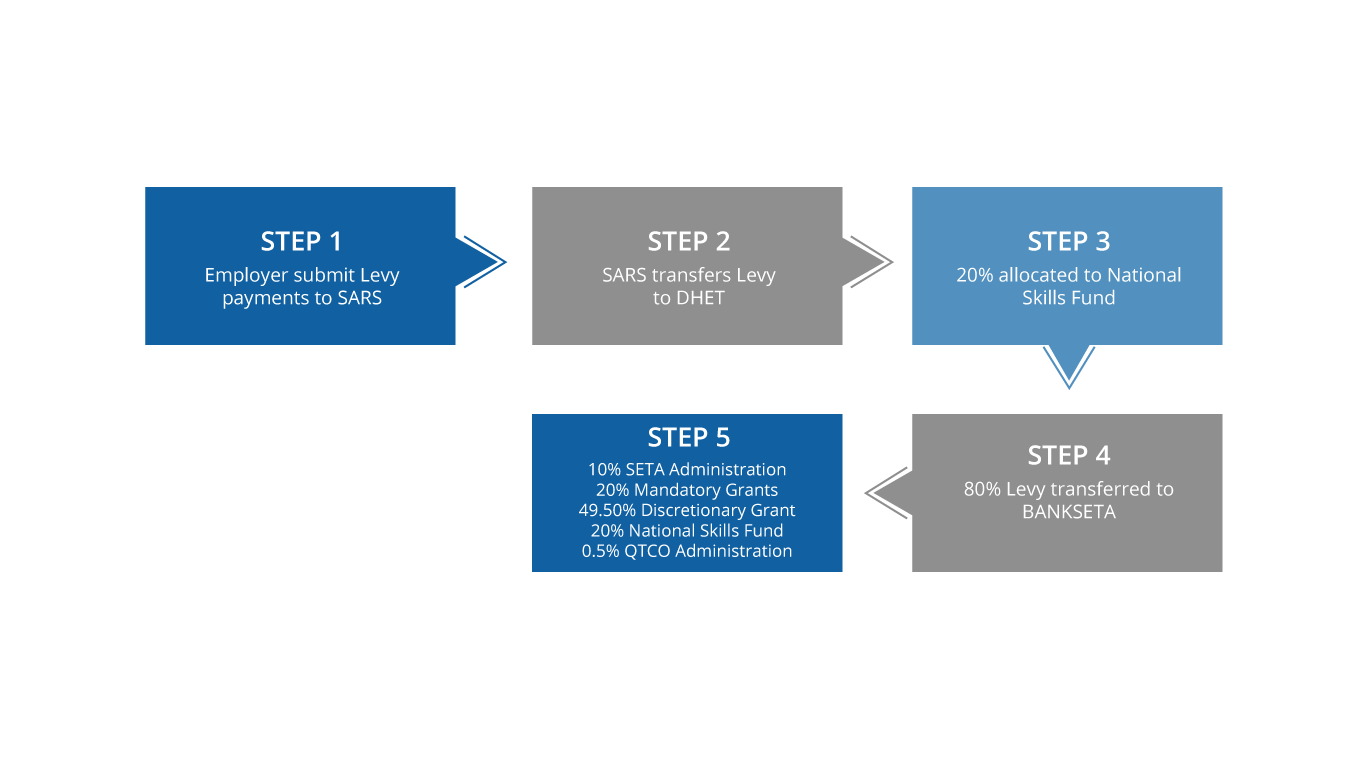

How payment of the Skills Development Levy works:

- Employers liable the payment of this Levy (SDL) to SARS, have to nominate the SETA related to their core business upon registration.

- The amount payable is calculated as 1% of the total amount of remuneration paid to employees. (Any prescribed exclusions that are not leviable are subtracted from the total remuneration).

- The monthly levy is paid to SARS, together with PAYE and UIF contributions.

- SARS allocates this to the relevant SETA.

Any employer exempt from SDL payment can apply for registration as a SASSETA non-levy paying member.

How to register for the Skills Development Levy:

- All liable organisations can apply with the EMP101 form (application for registration). SARS will then issue an EMP103 form (notice of registration) upon successful registration.

- Should the firm be in possession of an SDL number with a payroll in excess of R500 000.00 per annum, the employer must submit monthly returns via the EMP201 form.

- SARS will then issue an EMP213 as remittance advice.

- Should the firm be in possession of an SDL number with a payroll that is less than R500 000.00 per annum, no information (a nil return) is submitted on the next EMP201 form.

- Upon e-filing, SARS will grey out the SDL field.

- Thereafter, should the employer become an SDL payer, they will need to advise SARS of this. SARS will then free up the greyed area.

CLAIMING THE SDL

Mandatory grant payments are paid quarterly to qualifying companies. In the event that you

qualified for a grant, but have not received your grant payment kindly contact the Finance

Team at SASSETA at 011 087 5500.

Levy Paying

The Skills Development Levies Act (SDLA) of 1999 requires that employers with an annual

payroll of R500 000-00 or more, pay a skills Development Levy (SDL) of 1% of payroll. The

levies are collected by the South Africa Revenue Services (SARS) and transferred to the

relevant SETA via the Department of Higher Education and Training (DHET).

Non-Levy Paying

Registered, non-levy paying organisations are those which do not meet the threshold payroll

amount or who are levy- exempt. If you fall into this category you will still be required to

participate in the skills development process in order to qualify for SASSETA discretionary

grant-funded projects

Claiming your Skills Development Levy (SDL):

The flowchart below depicts the flow of levies and allocation.